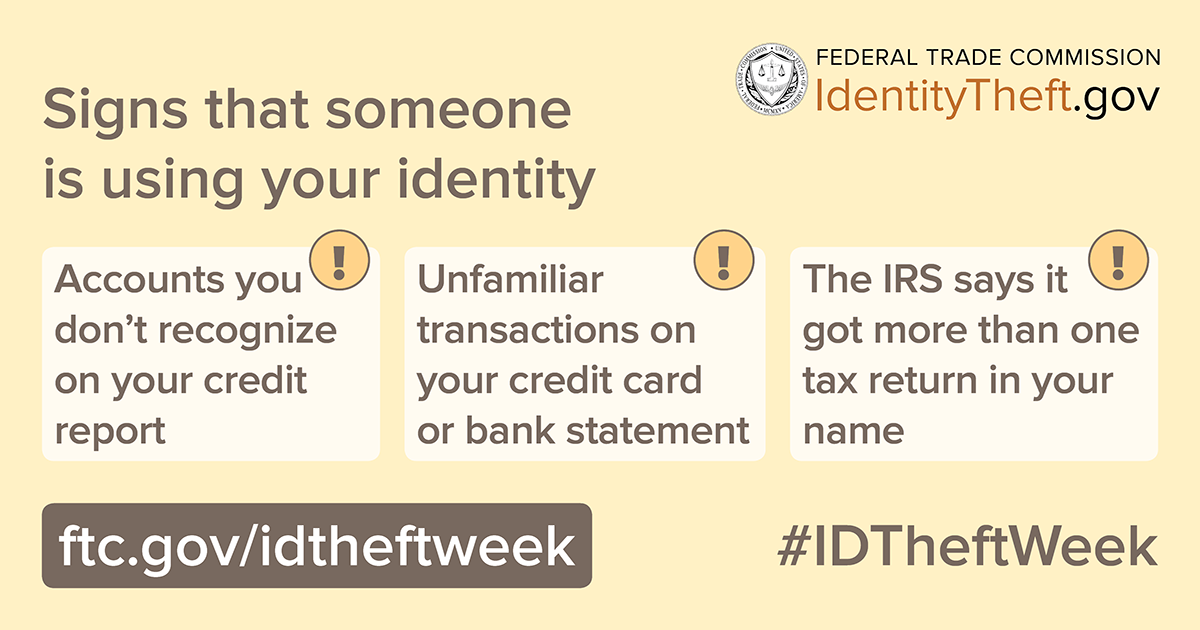

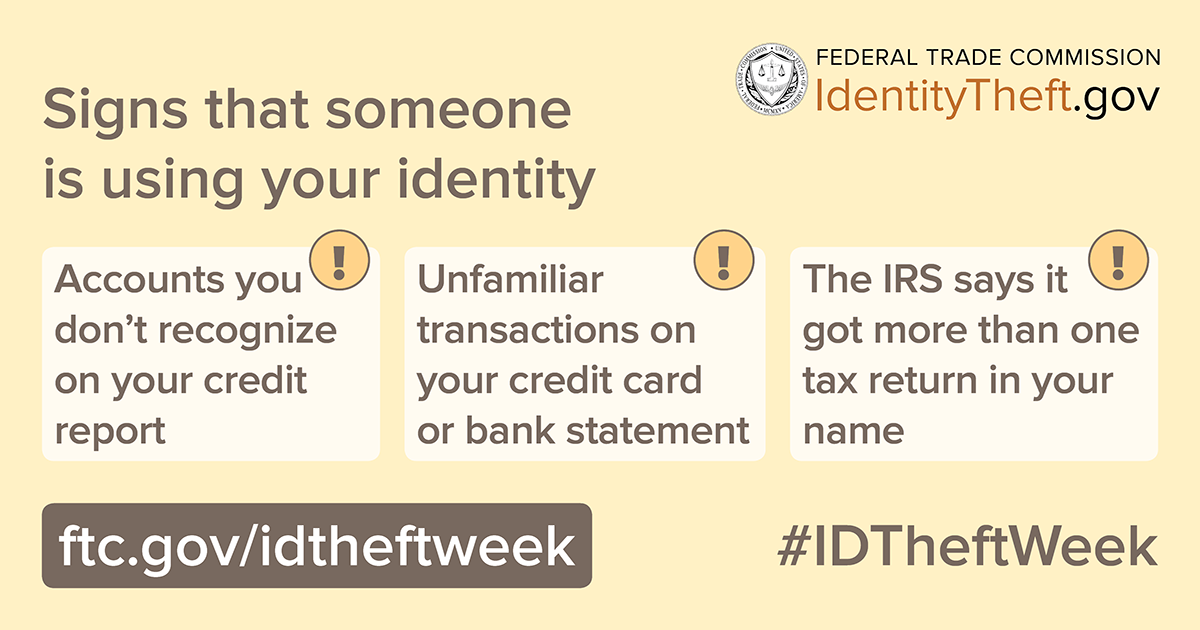

Taking steps to protect your personal information can help you minimize the risks of identity theft. But what if a thief gets your information anyway? Here are some of the ways thieves might use your stolen information and signs you can look out for.

An identity thief could use your information to get credit or service in your name.

An identity thief could use your credit card or take money out of your bank account.

An identity thief could steal your tax refund or use your Social Security number to work.

An identity thief could use your health insurance to get medical care.

An identity thief could use your information to file a claim for unemployment benefits.

If you discover any signs that someone is misusing your personal information, find out what to do at IdentityTheft.gov.

And remember to check out our daily free events and webinars with our co-partners during Identity Theft Awareness Week.

Search Terms Comments have been turned off for this consumer alert.It is your choice whether to submit a comment. If you do, you must create a user name, or we will not post your comment. The Federal Trade Commission Act authorizes this information collection for purposes of managing online comments. Comments and user names are part of the Federal Trade Commission’s (FTC) public records system, and user names also are part of the FTC’s computer user records system. We may routinely use these records as described in the FTC’s Privacy Act system notices. For more information on how the FTC handles information that we collect, please read our privacy policy.

The purpose of this blog and its comments section is to inform readers about Federal Trade Commission activity, and share information to help them avoid, report, and recover from fraud, scams, and bad business practices. Your thoughts, ideas, and concerns are welcome, and we encourage comments. But keep in mind, this is a moderated blog. We review all comments before they are posted, and we won’t post comments that don’t comply with our commenting policy. We expect commenters to treat each other and the blog writers with respect.

We don't edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain. To protect your privacy and the privacy of other people, please do not include personal information. Opinions in comments that appear in this blog belong to the individuals who expressed them. They do not belong to or represent views of the Federal Trade Commission.

Me. Scammer February 02, 2022Checking statements as they come in is a good idea but you need to be more proactive. It is safe to register for online access to bank and credit card and brokerage accounts. You can monitor them proactively rather than waiting for a statement at the end of the month. Check them weekly!

I'm Not a Robot February 02, 2022In reply to Checking statements as they by Me. Scammer

You don't always have to wait for monthly statements. My credit card bank lets me know immediately whenever a charge is made without my card being present.

jean davis May 23, 2022In reply to Checking statements as they by Me. Scammer

The bank I do business with has a 3 to call for checking balances/debits/credits, so I do that more than once a week. If I have a question about any of these items, I can call the bank and speak to a person for an explanation.

I'm also on Facebook and have scammer hack a friend's account, present themselves as this friend, and attempt to entice me into a scam concerning a government give-away of substantial money. These I can forward to the FTC.

I'm a senior, during the year 2021 in December ive got over 9 pages of scammers texts and calls that had Fraudulent intentions, this is very helpful, information. Thank you.

HOPE February 02, 2022As a result of my communication with various government agencies concerning the hacking of my SS#, my email addresses, and my phone I, yet to receive their input and what I’m supposed to do with this serious threats to my livelihood.

Hannah F. February 02, 2022I’ve signed up for credit card text notifications for years. Has stopped several credit card theft scams immediately, well worth it. Also, blocked credit inquiries with major providers since I’m a senior and don’t plan to apply for futher credit or loans.

I'm Not a Robot February 02, 2022I keep my physical cards at home, so I'm not carrying them around. Instead, I use the "wallet" in my cell phone to hold the necessary items. It requires that I use "facial recognition" to open the phone and to then open the wallet. Nearly all businesses now have "tap to pay" features, so I rarely find a reason to have the actual card with me.